Build your faith belief foundation

Build your faith belief foundation

Are you looking for answers to life’s most pressing questions?

I’ll help you understand the Bible, while making sense of our mixed up world.

Understand the Bible

Did God Create All Nations From One Blood?

Acts 17:26 has confused many Christians. Is Scripture telling us all races came from Adam and Eve, or is there another meaning?

James

We discover how to overcome sin and learn from our temptations. God provides guidance for all walks of life, teaching us how to be good Christian people.

Ask a question

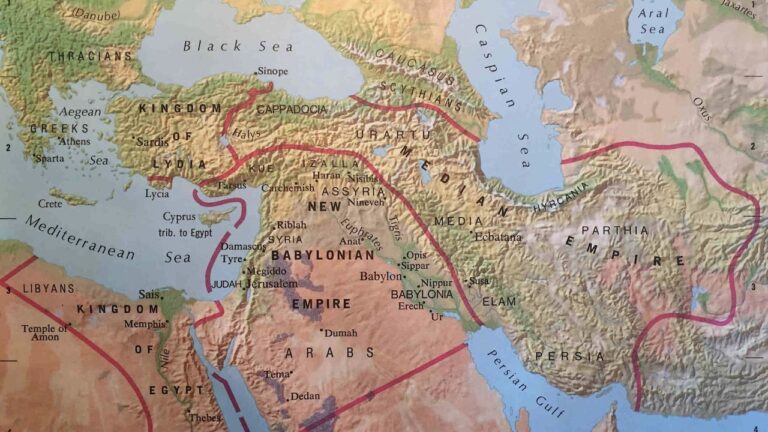

Why Does The Euphrates River Dry Up In Revelation?

The Euphrates River dries when the Sixth Vial is poured out. The time when Satan gathers the kings of the earth to make war against Jesus and His Armies.

Why Don’t Christians Follow The Old Testament?

Today, Christians are not obligated to follow every aspect of the Old Testament. When Jesus came, He fulfilled much of it, by becoming it.

Does God Know When We Will Die?

The Bible says God is all-knowing, but does that mean He knows our future and we have an appointed time to die? Let’s examine the thought and its implications.

Make sense of the news

Christian commentary

Have More People Been Killed By Abortion Or War?

If you had to take a guess, have more souls been lost due to war, or due to abortion? Many of us would probably say war. War brings thoughts of blood and death in massive

Ashkenazi Jews Are Not Biblical Israelites

Most Christians believe Ashkenazi Jews are the descendants of Biblical Israelites, but is that true? I discuss Scripture, history, and science to learn the truth.

Don’t Be An Unteachable Christian

As people, and especially as Christians, we’re to always remain teachable. What does that mean? It means, we should never think we have it all figured out. If we do, we most certainly fell into