Build your faith belief foundation

Build your faith belief foundation

Are you looking for answers to life’s most pressing questions?

I’ll help you understand the Bible, while making sense of our mixed up world.

Understand the Bible

The Meaning Of The Christian Fish Symbol

The Christian fish symbol is composed of five Greek words that form the acronym IXOYE, which means, Jesus Christ, God’s Son, Savior.

The Parables Of Jesus

Not everyone was meant to understand the parables of Jesus, only the Disciples, and Christians like you. To understand a parable, you need spiritual sight.

Ask a question

What Does The Bible Say About Homosexuality?

God is against homosexuality, and while God loves sinners and wants them to repent, God hates the wicked and those who take pleasure in unrighteousness.

Who Are The Two Witnesses In Revelation?

The Bible does not say who the Two Witnesses of Revelation are. Though we can get a good idea. Personally, I believe they will be Elijah and Enoch.

Is Believing In Jesus Enough To Be Saved?

The Bible explains we must believe in Jesus to be saved. Yet, there is more to salvation as Scripture reveals. We must believe and do the words of Christ.

Make sense of the news

Christian commentary

God Is Amazing: Look At This Awesome Universe Size Comparison

More often than not these days, we are told God does not exist, that He is a figment of our imagination. Yet, when we observe the universe, we can see God does exist by looking

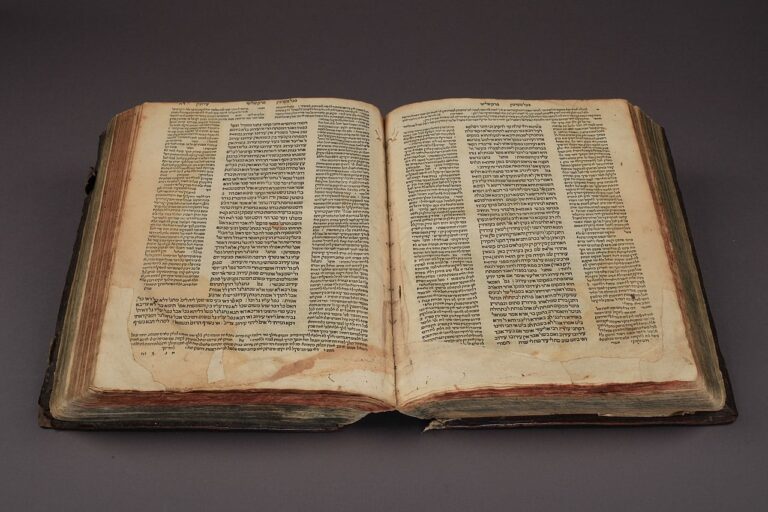

Talmud: The Dangers Of Judaism

We commonly hear, the Jews are God’s chosen people, and Judeo-Christian values bind us together. So what does the Talmud say about the values of Judaism?

A Nation In Peril

The United States was once a blessed nation, but it’s now in peril as society falls away from God. How do our elections play into this, and how should we vote?