Build your faith belief foundation

Build your faith belief foundation

Are you looking for answers to life’s most pressing questions?

I’ll help you understand the Bible, while making sense of our mixed up world.

Understand the Bible

Who Is The Antichrist?

The Antichrist appears before Christ displaying signs and miracles which convince the world he is God. We will learn, that this entity is Satan himself.

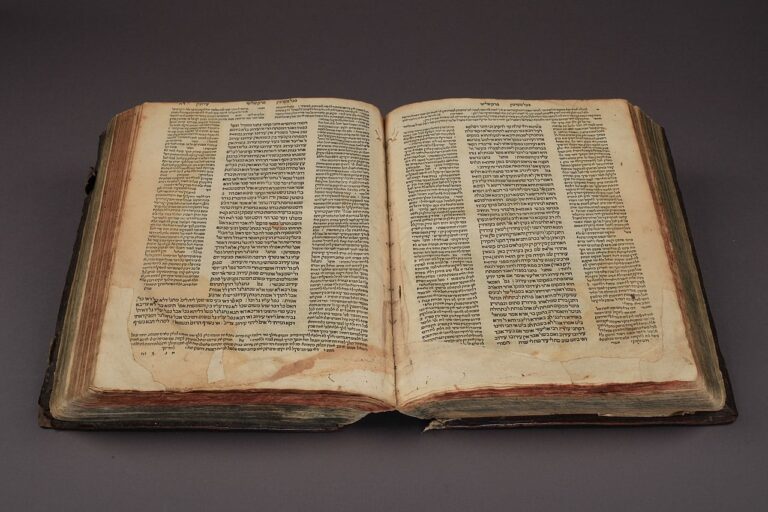

How We Got The Bible And Its History

Learn how we got the Bible and its history. We discuss manuscripts and how they formed the Bible including their remarkable existence despite the age of time.

Ask a question

Why Is One Taken And The Other Left In Matthew 24:40?

Jesus said His return is like the Days of Noah, when they were taken by a flood. That is a parallel to one taken, one left. The one taken is taken by a flood.

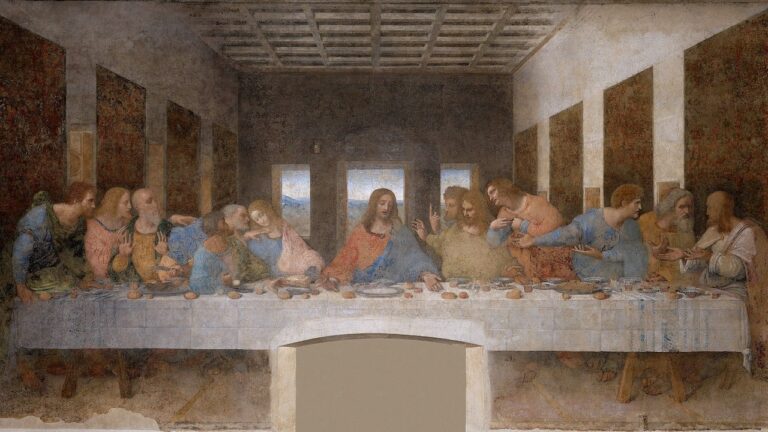

How Did Judas Die?

Did Judas hang himself or fall, and who purchased the potters field, Judas or the priests? Do these subjects contradict? Let’s open the Bible to clear it up.

What Is Jesus’ Real Name?

The name of Jesus is spelled according to the language being used. We must preach Jesus in the language of our audience as He instructed. We dive into the details.

Make sense of the news

Christian commentary

Do You Want To Know The Truth?

Everyone says they have the truth, then you find out they believe differently than you, so who’s right? We only obtain truth by challenging our beliefs.

Talmud: The Dangers Of Judaism

We commonly hear, the Jews are God’s chosen people, and Judeo-Christian values bind us together. So what does the Talmud say about the values of Judaism?

Did Jesus Exist?

Today, society paints Jesus as a mythical figure. However, by reviewing secular history from writers of the ancient past, we find proof that Jesus did exist.