You want to keep a close eye on economic news this week, no matter if you invest or not. We are seeing a massive and sustained downward trend in stock prices. I feel this is going to tell us where our world is headed.

Our big tech mortal enemies, Google and Facebook will release their first-quarter earnings this week. Last week, big tech was busy falling like a rock.

By the way, do you realize since August of 2021, Facebook’s stock has dropped in half?

“Hallelujah,” I say!

Speaking of falling like a rock, did you see what happened to the stock market on Friday?

KABLOOEY!

The DOW dropped 981 points, its worst performance since the COVID catastrophe of 2020.

Do you know why?

Two reasons…

#1, It’s due to the massive downward trend that really started back in February 2021.

Back then, lots of stocks began the long move down. More recently, the biggest stocks that have been holding up the market are now turning negative, which is finally bringing the whole market back to earth.

Yet, there’s a much more important reason for the 981 point drop story.

#2, On Friday, Federal Reserve Chairman Jerome Powell said,

“It is appropriate in my view to be moving a little more quickly” to raise interest rates, Powell said. “I also think there is something to be said for front-end loading any accommodation one thinks is appropriate. … I would say 50 basis points will be on the table for the May meeting.”

CNBC

50 basis points…

That means, the Federal Reserve is talking about raising rates by half a percent. They already raised it .25% at the last meeting.

Given the fact that CPI inflation is 8.5% and rising, .5% is a drop in the bucket. However, this is still pretty big news. That’s why the market tanked. Powell’s remarks indicate that easy money is a thing of the past, for now…

The Federal Fund Rate has been at next to zero since 2020. That’s the standard interest rate that essentially sets the tone for all interest rates. Even more noteworthy, from 2009 to 2016, the Federal Fund Rate was essentially zero.

This is one of the reasons the markets have been propped up for so long.

Low-interest rates and Federal Reserve intervention has altered our markets for 13 years! It has punished the guy who stayed out of the markets for fear of losing his Denaros, while benefitting those who go into debt.

Speaking of debt, “margin” as they call it in the stock market is dropping like a rock! That’s when you borrow money to invest in the stock market. The more margin that gets wiped out, the further stock prices will fall.

As I said, it’s been a wild casino for 13 long years!

By the way, do you realize just months ago, mortgage rates were around 3%, now they are 5.35%?

Mortgage rates and all rates are going to go higher, which means, house prices are “going down, down, down” as Johnny Cash would say.

Now add in this new rate hike expected early in May, and the many more expected, and it’s going to raise interest rates even more.

The winds of change have shifted once again.

This is going to tie into an article I wrote back in January, but first…

I want you to remember what has happened these last two years.

Inflation Raises Asset Prices

If you don’t have assets, say, land, houses, yachts, etc. Well then, money is siphoned from your pocket through higher food prices, fuel, etc which ends up in the hands of those who do own assets.

This is no secret, it’s been laid very bare due to the most massive money printing in world history that has taken place.

Who dun it?

President Trump and President Biden.

Remember all the articles telling you that the rich got richer during the pandemic?

All those freshly printed dollars made their way into their pockets. Lockdowns meant more online shopping at Jeff Bezos Amazon, etc. You get the gist.

Now look at this.

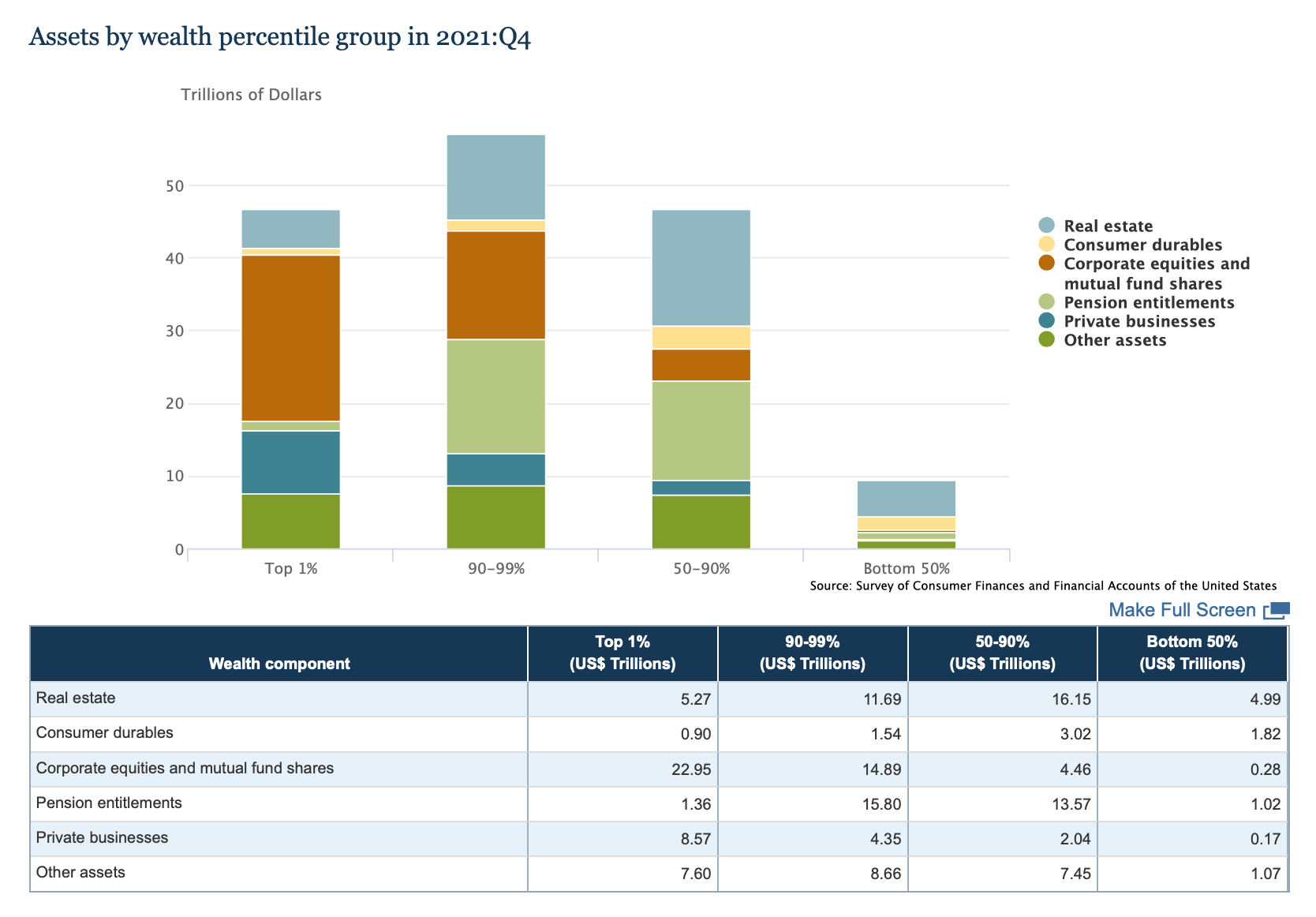

This chart comes right from the Federal Reserve. You are looking at the assets owned by economic class.

You see that little pile for the bottom 50%?

That’s most people, that’s the pile of wealth they have.

Now that’s just for the fourth quarter of 2021.

Study and news with a fresh Christian perspective in your inbox.

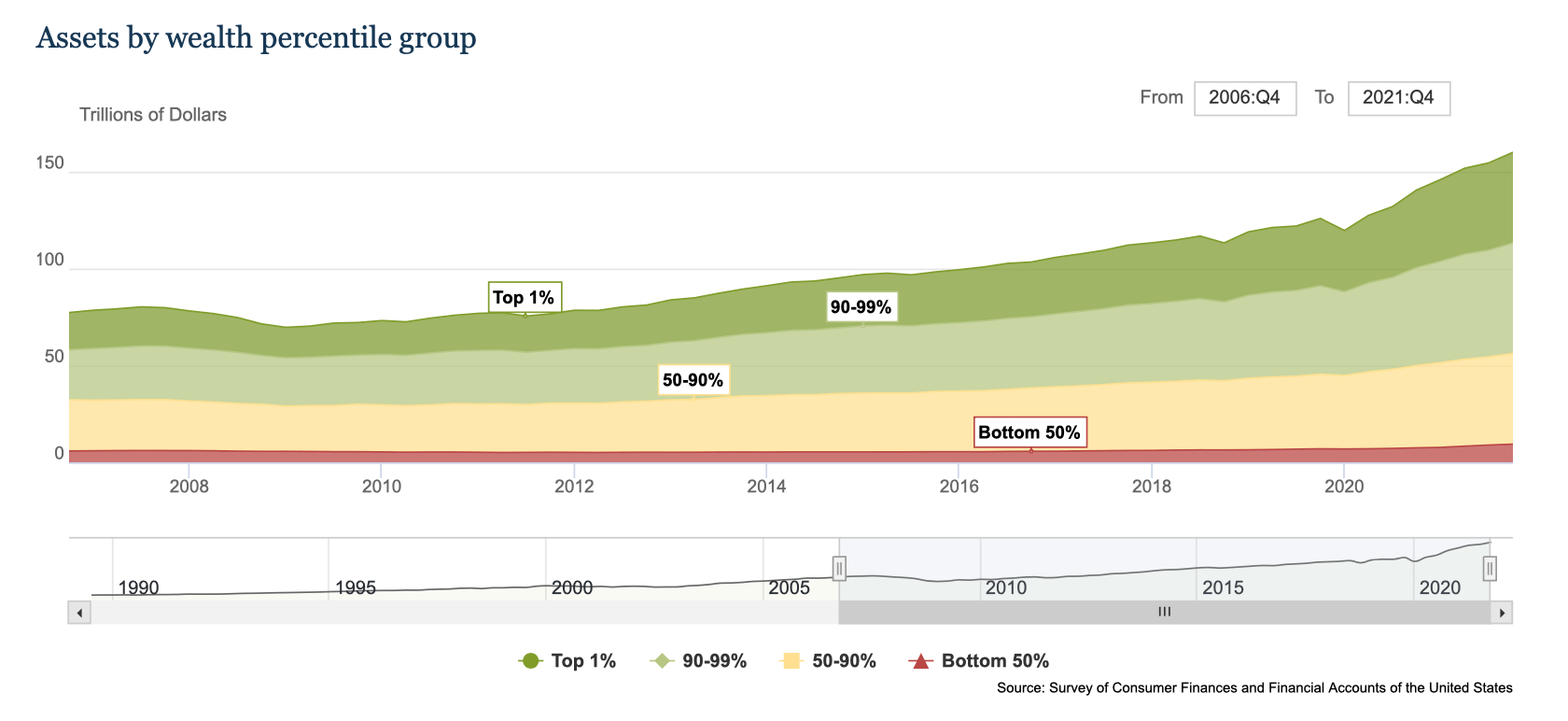

I have an even better graph for you!

This one is over time, from 2006 to 2021Q4.

See the bottom 50%?

That’s most folks, probably most of our readers fit into that slot. While the assets of the ultra-rich shot through the roof due to inflation, ours, not so much. So this whole money printing binge our government went on to “save us” did nothing of the sort.

It simply made the rich richer.

That’s the idea, more campaign contributions, more pork barrel spending!

So the ultra-rich bought more houses, more land, more yachts, more businesses, you name it. Politicians and these ilk rub shoulder to shoulder.

On another note, do you honestly think if the stock market drops they care that much?

Well, they care, but not as much as we might think.

They already got their booty!

Assets are what really matter, not an inflated portfolio of cash. Cash is just a tool to acquire assets. Assets will create wealth on their own.

Now that inflation is so high and disastrous, the Federal Reserve has to change course, or the whole system is going to go, kersplat! Inflation cannot be perpetual.

Economic Kersplat!

Ahh…

Remember that one?

- Is The Global Economy About To Go Kersplat?

In that article, I put together “3 Points Of Economic Pain” that we may witness in the future.

They were,

The Federal Reserve does not raise rates, and continues to inflate the economy into oblivion.- The Federal Reserve raises rates (according to plan) which scales back the economy and we go through yet another cycle.

- The Federal Reserve does the above, but the global economy spirals out of control. Think worse than 2008. In light of the last two years, we can envision a world working together like never before to bring about a more tight-knit world; ie: globalization in order to save the system.

For now, I am crossing #1 off the list. It’s too early to know for sure, but the Fed has priced in interest rate hikes at every meeting this year. Seven more to go if I recall. This news is scaring the stock market speculators.

Inflation is still going to surge for awhile, and the Fed could backtrack if the markets tank too much, too fast. Time will tell…

However, we look like we are on item #2 from that list right now. If you recall from the early 1980s, interest rates were extremely high.

Are we returning to those days long ago?

Or are we going to get item #3?

You will want to read that whole article for more elaboration on what each point means. Nevertheless, as of today, we can clearly see the Fed is raising rates and they are also planning to cut their balance sheet at May’s meeting.

What’s that mean?

Now you remember the term “Quantitive Easing,” that was when the Fed printed billions and trillions to fix the system back in 2008 and even in 2018. Well, now they are planning to go in reverse, they are going to “Quantitive Tighten” which means they are going to sell assets.

They are going to sell assets off their balance sheet so the market, ie: you and I, governments, and corporations pick up that slack. Now the doomers said this would never ever happen again. Yet, it’s in the process of it right now.

That’s why you don’t listen to doomers. They are good at one thing, SELLING you doom!

Ahh, but I digress…

Where Do We Go From Here?

That’s what everyone wants to know.

The year is 2022, and the United Nations 2030 Agenda is raging forward. I don’t think the events of the last two years were an accident. I mainly speak of the COVID-19 pandemic and the rise of wokeism. If you are a long time reader, you already know where we stand on that.

It’s clearly moving our world further away from God, and into a world of government dependence. Even global government ideals. We see this with digital ID, digital currency, and so on.

The economy is truly beginning to change course. I still wonder, what of the three items will we get, though I safely say we have narrowed it down to #2 or #3. That’s a big difference, and it will mean dramatically different things for our world.

I truly believe, the remainder of this decade is going to pinpoint where we are on God’s timeline.

So while we continue to watch world events, don’t forget to go play and enjoy life. That’s why God put you here. To enjoy life and serve Him, not to worry about the “cares of this life,” (Luke 21:34).

Otherwise, you end up like the seeds that fell in the thorns.

Luke 8:14

And that which fell among the thorns, these are they that have heard, and as they go on their way they are choked with cares and riches and pleasures of this life, and bring no fruit to perfection.

That’s right, it’s not only people who become distracted by their wealth, but those who are choked by the cares and pleasures of life. By being overly concerned about this or that event or problem in life.

Hey, focus on Christ!

Keep cracking open that Bible, and be that Christian example for everyone around you.