Staying out of debt is easier said than done, I know.

However, it’s something you can do, and it’s something you should be practicing everyday.

As Christians, we are in this world, but we are not apart of the world, (John 17:14-16). It’s the world that tells us to go spend what we don’t have, to obtain what we don’t need. When we fall into that trap, we fall into hedonism. We become worldly without even realizing it.

Unbeknown to many, the global economic system is based on debt and people using it.

That’s why you stay at the bottom, and the other guy stays at the top.

Then, those big boys bet on debt, they leverage debt to make more money. It’s a Ponzi scheme, but your everyday American doesn’t see that big picture. They only see the new TV they can get, that they don’t need. They only see the new car, when there’s works just fine.

I tell you what, no one ever became well off by spending, only by saving.

In fact, all of that is very Biblical.

Proverbs 22:7

The rich ruleth over the poor, and the borrower is servant to the lender.

If you borrow money, if you have debt, you are a slave to another man.

God does not want you to be a slave.

Christians are not slaves.

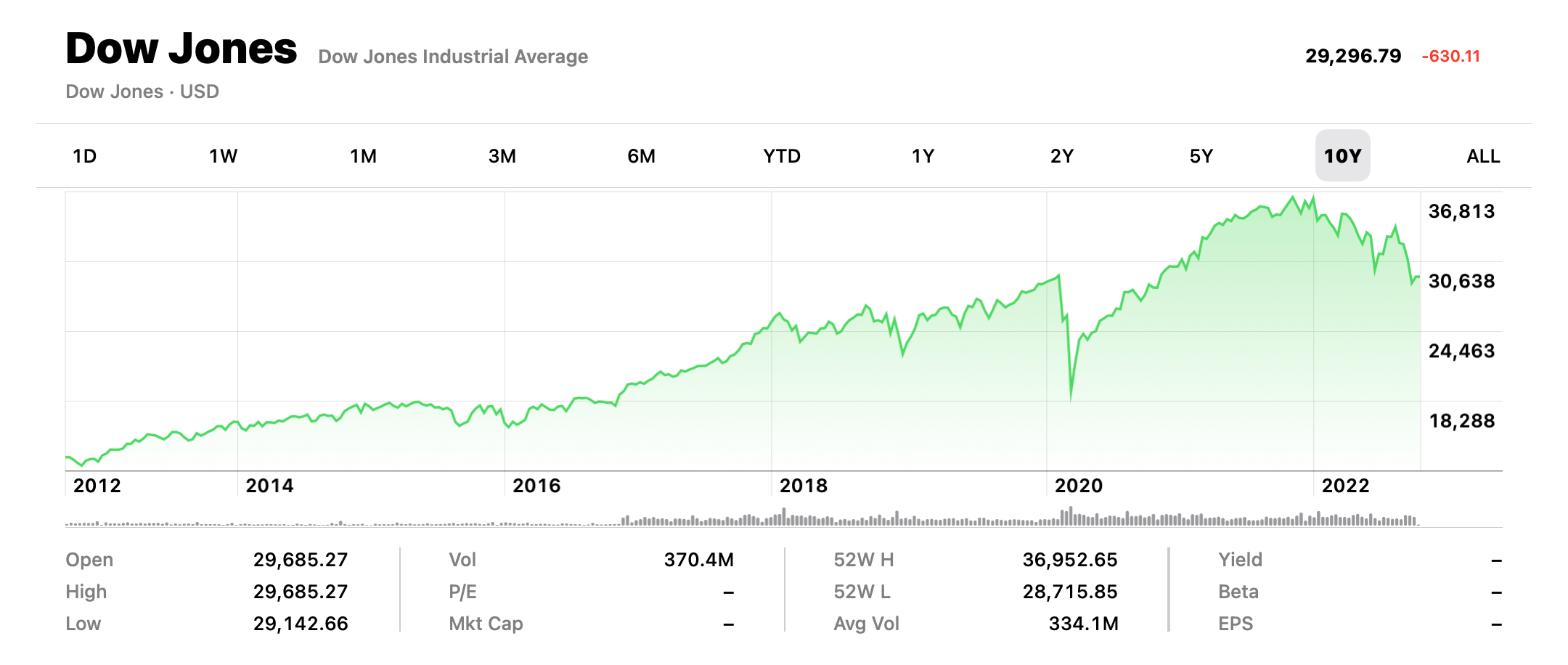

Crumbling Financial System

I bring this up today as the global financial system continues to collapse under its own weight.

You do not want to be under that weight. You do not want debt in this environment. If you lose your job, you risk losing your (the banks) home, car, etc. Interest rates continue to rise, and companies are already cutting back, even Amazon.

Stay out of debt!

I’ve been saying for years, ‘the financial system never recovered from 2008. They never fixed the system, all they did was paper over the problem.’ All they did was print their way out of the crisis by creating currency from nothing, and lowering the interest rates.

Governments around the world exacerbated this during the COVID-19 pandemic. They did this to keep the global economy from collapsing, but this actually made the debt trap even worse.

How so?

- By creating trillions of dollars, and putting it on the street.

- By lowering interest rates to record lows.

Now we have massive inflation, around the globe.

So, central banks world wide are raising interest rates and shedding their assets. This is causing global markets to collapse. As I’ve said for years, if the market is so healthy, it never would have needed the help of central banks to begin with.

This only proves my long held point, the problems from 2008 were only papered over…

It was a long bull run, but now the chickens are coming home to roost.

Look at this…

It’s grim, but the market must come back to earth.

Especially the housing market that shot into the stratosphere! All thanks to government money printing and low interest rates. Of course, this includes the disastrous monetary policy of our central bank, the Federal Reserve.

They purchased (with nonexistent money) record amounts of Mortgage Backed Securities (MBS). Basically, they became the purchaser of the debt you created when you went and got that mortgage, I mean home. Now, the Federal Reserve is beginning to shed MBS.

That means, investors on the street need to purchase them. Since no one wants to invest in any financial instrument at low interest rates, we’re seeing rates rise. The Fed is raising these rates and shedding assets in an attempt to halt inflation, they are taking the patient off the drugs.

Ohh, don’t forget, the mainstream media also contributed to the housing market euphoria! They hyped the housing market so much, people developed a “fear of missing out” (FOMO), so folks went into debt far more than they should have for a home.

Fools.

They are now laden with loads of debt for a home that was never worth the price they agreed to.

These Are The Dangers Of Debt

That’s only part of the story.

Since this article is about debt, and you staying out of the financial tsunami headed our way… I want to show you how debt destroys your potential wealth.

Let’s say…

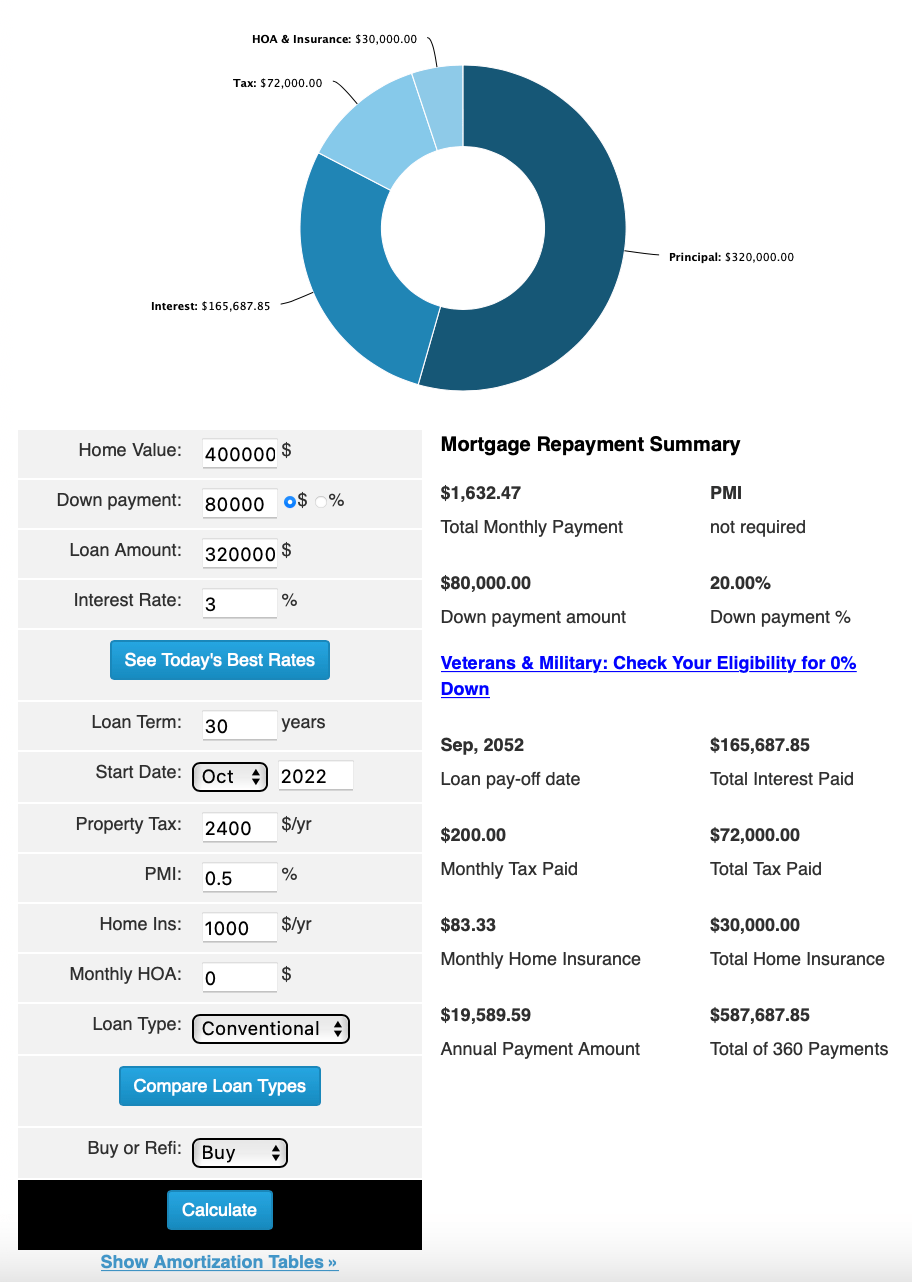

- We bought a $400,000 home.

- We have a downpayment of $80,000.

- We finance $320,000 of the total.

- We got one of those record low 3% rates!

That means:

Study and news with a fresh Christian perspective in your inbox.

- Our monthly payment is $1,632.47 for 30 long years.

- Interest during the life of the loan: $165,687.85.

That means, we paid $165,687 dollars more than the house was worth. We worked to pay someone else $165,687 for the privilege of living in the house now, instead of later.

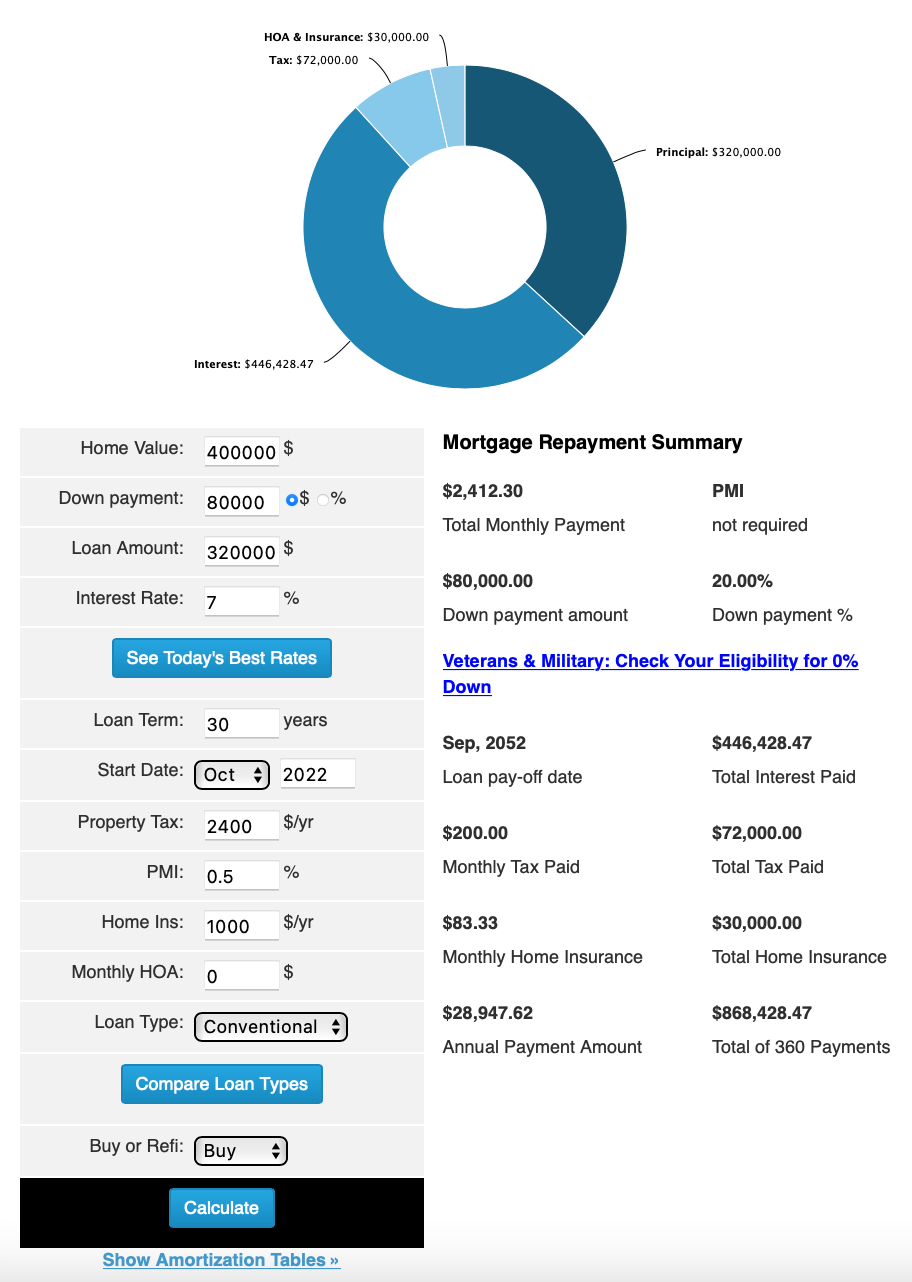

Now, same scenario, only we change the interest rate to what it is presently.

- We bought a $400,000 home.

- We have a downpayment of $80,000.

- We finance $320,000 of the total.

- We have a 7% interest rate.

That means:

- Our monthly payment is $2,412.30 for 30 long years.

- Interest during the life of the loan: $446,428.47.

Just that little change from 3 to 7 percent means our monthly payment went up by 50%!

Even worse, the interest we are going to pay for the home almost tripled! We could have purchased another home for that price.

That is how debt destroys your wealth.

That is how you, the debtor, become servant to the lender.

Think about it…

How many more years are we going to have to work to pay off all that interest?

If we reverse the psychological hypnosis we are under…

First, we would save for the house.

Yes, it will take years of saving.

Yes, it takes discipline.

However, you will make income off of your savings. In the end, you will work far less to acquire the same house. Instead of working for someone else to pay interest, you will be paying interest to yourself as your savings compounds from one month to the next.

Now, put this into the same perspective as purchasing a; car, boat, ATV, and so on.

Think of the money you can save over your life by not paying interest. Think how much less you have to work, how much less you need to earn by just being patient and saving.

Not many people are going to tell you these things.

The reason is simple, the world makes money by selling you things.

The world makes money by selling you debt.

All right, before we conclude, there’s one more thing we need to talk about today…

The Future

I want to remind you about the article I penned to start of 2022.

It’s titled, Is The Global Economy About To Go Kersplat?

Specifically, the 3 points of economic pain section.

Let’s just copy and paste them right here:

The Federal Reserve does not raise rates, and continues to inflate the economy into oblivion.- The Federal Reserve raises rates (according to plan) which scales back the economy and we go through yet another cycle.

- The Federal Reserve does the above, but the global economy spirals out of control. Think worse than 2008. In light of the last two years, we can envision a world working together like never before to bring about a more tight-knit world; ie: globalization in order to save the system.

I crossed off option one earlier this year. Now, we are left with option 2 and 3. It’s the only two options left. The so-called experts keep saying the Fed is going to “pivot” and go back to lowering rates. They’ve already been wrong, and will most likely continue to be wrong.

It seems, we have ended the era of cheap money which has created a massive debt problem. That means having debt will cost you even more, as we saw with the housing example.

Considering the state of geopolitics right now, option 3 is starting to shine, but it’s far too early to tell. I believe the economy will continue to fall a part. It’s been based on cheap debt for far too long, and now, debt is costing more and more by the day.

Why?

Interest rates continue to rise.

Regardless of what happens around us, focus on the things you can control.

You can control what happens in your circle. You can do that by staying out of debt to avoid the pitfalls we have discussed. Continue to build your savings, and invest in the products, services, and people that invest in you.