Build your faith belief foundation

Build your faith belief foundation

Are you looking for answers to life’s most pressing questions?

I’ll help you understand the Bible, while making sense of our mixed up world.

Understand the Bible

The Timeline Of The Tribulation

The Tribulation will be an unprecedented time in world history. We take you through the Revelation timeline to understand the events of the Last Days.

James

We discover how to overcome sin and learn from our temptations. God provides guidance for all walks of life, teaching us how to be good Christian people.

Ask a question

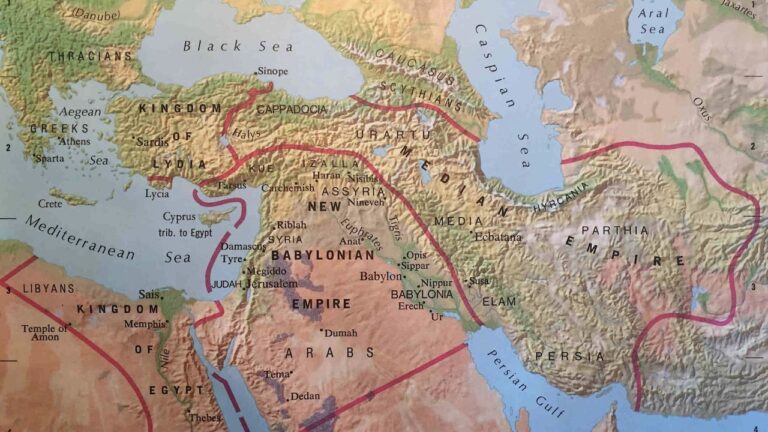

Why Does The Euphrates River Dry Up In Revelation?

The Euphrates River dries when the Sixth Vial is poured out. The time when Satan gathers the kings of the earth to make war against Jesus and His Armies.

Who Are The Hebrews, And Where Did They Originate?

The Hebrews are the descendants of Abraham. Before God led Abraham into the land of Canaan, God led him across the Euphrates River from the east.

Why Don’t Christians Follow The Old Testament?

Today, Christians are not obligated to follow every aspect of the Old Testament. When Jesus came, He fulfilled much of it, by becoming it.

Make sense of the news

Christian commentary

Is The World Destroying Christianity Or Are We Destroying Ourselves?

The walls are beginning to close in on Christians. The world has been gunning for Christianity since its birth. Yet, there were many good times, and Christianity spread throughout the world, helping the world. Helping

We Have A Soul, Consciousness Found In Brain Dead Patients

I watched this video the other day with Neurosurgeon Michael Egnor. He explained how scientific studies have shown people have consciousness, even when they are clinically brain dead. He explains, this proves the existence of

A Personal Story Of Patience

I have a personal story for you today. I originally planned to post another article I wrote this morning titled, “People See Who Jesus Is By Looking At Our Lives”. I proofread that one yesterday